Why do you need extra income? One of the key to

financial prosperity in the family really is not in how large the amount of your income, but how do you manage such income. Regardless of the amount of income in your family, if you can not manage it well, then welfare will not achieve.

However, should you not need to sadd extra income in your family? Not really. Large income does not guarantee that your family can achieve financial prosperity, but large income can help your family prosper. So once again, great income does not guarantee, but only help. Therefore, it would be better if you could increase your revenue sources.

There are a number of ways to supplement your income in your family:

1. Working as an employee

2. Work by relying on the expertise

3. Running a Side Business

4. Investing

1. Working As An Employees

You can earn extra income by working at a company. You can work as a secretary, bookkeeper employees, administration, or whatever it is. Importantly, you get a paycheck. So at this point if you do not work and only your husband's work (as an employee as well for example), then by now you also work as an employee, then there will be two salary in your family.

Or, if for example at this time you've worked as an employee, maybe you can become an employee also in other places. So you get two salaries. A friend of mine worked at a company from 9 am until 5 pm. While the evening he also worked in a restaurant from 6 pm to 10 pm. He got two salary in a month.

What is the advantages and disadvantages to working as an employee? Clearly, working as an employee is good, because you just come, work, and at the end of the month get a salary. You just need to obey the rules of working hours only.

The drawback, of course, that if you do not work, you will not get a salary. Simple as that. That is why many people who are aged 50-60 years and still working as an employee for fear of not getting a salary if he does not work anymore.

Working By Rely On Your Expertise

If you have any special skills, you can work and earn fees from it. For example, if you can sing, you can sing at parties and get the fee. Well, if you can teach, you can teach and get the honorarium.

Work by yourself must be distinguished by working as an employee. As an employee you get a salary, whereas here you do not get a salary, but get the fee. Examples of those who work by relying on the expertise and get the fees in general are the artists who play the soap opera, or a doctor and an architect who opened his own practice to get paid from the patient or client.

If you notice, in fact almost every person had the expertise or specialized skills that can be sold. The problem is if you dare to make the expertise or skills you have to be sold to the public?

Excess work by relying on expertise is that you will get the income that is consistent with your skills. That is, you will be motivated to further deepen your expertise so that it will get paid more. The drawback is, if you do not work, you will not get paid.

Running a Side Business

Why do not you try to run a side business? You can open a shop or stall. You can open a service bureau that sells all kinds of services. Why do not you try it?

The important thing here, a side business that you run someday will leave their management to subordinates who you trust, so you do not need to continue to engage in it for the rest of your life. Shop for example. You might be able to open a store selling goods of daily needs. After a few months, you could give the management to your subordinates (which you pay of course), so you can be comfortable watching TV at home but can still get the income of the store each month. This is the advantage of running your own business.

Maybe you think that to be successful in the business need substantial capital money. But you may not believe, the success of a business often does not depend on the size of your capital. Please see around you, there are many people who succeed in business with little capital. The most important thing here is the idea.

There are some businesses that require a substantial initial capital, but many businesses that do not require initial capital that is too big. The most important thing here is how you can "outsmart" the amount of money you have now to be sufficient to be able to run a business idea in your head. By running a business, you are automatically better trained to be independent and survive. That's the other advantages of running your own business.

Investing

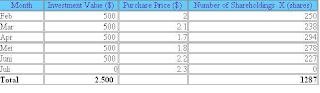

Do you have excess money? Why not

invest it? If you have $1 million, maybe you could make a deposit, and there is additional income from the interest.

You've got stuff you do not use anymore? Furniture for example? Why do not you sell it and invest the money by buying gold, for example. After a two or three years, let's hope that gold prices are rose. Well, the difference in price increases is additional income for you.

For those of you who are single (have no dependents) and live in their own home, why do not you just rent out of your home? Thus, you will get additional income from the rental income the house every month or every year. Or if your house is rather big, why not rent one of these two rooms to be used as boarding-lodging petty? You will be additional income from his boarding money, right?

Willingness Is The Important

Looking for Extra Income is actually not difficult. The important thing is you've got the will. If you do not have the will to want to earn extra income, then any way indicated to you would be hard to receive.

So, all originated from the will. If indeed there is no will, yes, your circumstances remain as they are now. But if you really want, you have 4 options to earn additional income as above.