Tips for Planning a Family Vacation

Talk about vacation is fun, especially when the whole family participates. Enthusiasm can go on living if done with careful planning. It is important that time is come, not one important thing missing. What should be prepared?

Research

Hold a small research by online. Sign in to mailing list or join a traveling social and exchange ideas with those who are experienced in planning a vacation. Compare vacation packages prices on travel agents with one another.

Determine the time

Decide when you want your family to travel. If the child has been in school, wait until the holidays arrive.

Location

Decide where you will go. If the age of the child is old enough, involve them in the determination of this tourist destination .

Transportation

What transportation will be used? If using your own car, do not forget to check the overall condition of your car. When using public transport, choose a safe and convenient one. Remember, do not be swayed with cheap price! Security and safety of your family is more important.

Use Maps

If your car is not equipped with a GPS system, do not forget to bring a map. Just in case, you are confused which route to take. Never be ashamed to ask in order to quickly get to the destination! Just because you are embarrassed to ask then you even has lost, and kids were exhausted and would not excited to go on vacation again .

Schedule of events

Be prepared to unexpected situations that may occur along the way. Decide what will be done along the way by each member of the family, especially the children. Plan a schedule of activities to be carried out. Encourage children to voice their opinions. Thus the child also learns to argue and compromise.

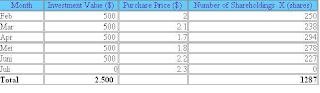

Detail of costs

Calculate and set how many family members will participate so that travel costs can be estimated . Record the details of the cost that you will incur. Make sure the cost includes the cost of the hotel a night, cost per person per meal, transportation, recreation tickets ( such as tickets to the zoo , swimming , and so on ) .

Although ATMs are widespread, still provide cash money to buy gas, food or other unexpected needs. If you will be traveling abroad, before leaving change your money in the currency prevailing at the destination. Do not forget also to find information from reservation services international

To anticipate that travel costs do not exceed your budget, you can look for discounted package alternatives that are usually available during the holiday season arrive. Please choose carefully!

If there is relatives or close relatives who had not been visited at a vacation destination, take advantage! You can save on the cost of staying.

Put your pet in animal care center

Start looking for the animal care center (if you have pets ) . When you decide to bring a pet, remember that these animals cannot get in a restaurant or hotel. Give the child the sense that a cat or dog is better deposited in animal care. Leave your phone number in the custody officer to keep watch.

Get ready to pack

Now it's time to pack luggage. Bring clothes as needed, but do not forget to bring extra clothes.

Adjust clothes to the weather conditions at the destination. Clothing and equipment for every person should placed in a separate bag. This will prevents their stuff mixed up and avoid the occurrence of seizure.

Supervise children

Do not let go of your supervision of children. Make sure all family members who participated always together in a group. Remember, evil is always lurking everywhere! Do not let your vacation end up with disaster.

Happy Holiday ...